The Truth Behind SharkShop Credit Score SuSSNess

**The Truth Behind SharkShop Credit Score SuSSNess: Unmasking the Myths and Facts!**In a world where financial literacy can feel like navigating a treacherous ocean, understanding your credit score is like learning to swim with sharks. With so much misinformation swirling around, it’s easy to get swept away by rumors and misconceptions.

Enter Sharkshop.biz a name that’s been making waves in the credit industry. But what does it really mean for you? In this blog post, we’re diving deep beneath the surface to uncover the truth about SharkShop’s approach to credit scores. Are they truly riding the wave of success, or are there hidden dangers lurking below? Join us as we explore both sides of the current and equip you with essential insights that could change how you view your financial health forever!

Introduction to SharkShop and Credit Scores

Are you curious about SharkShop and its connection to credit scores? You’re not alone. Many people are eager to understand how their financial health is linked to this popular platform. With so much information swirling around, it’s easy to feel overwhelmed or misled.

But fear not! This blog post will dive deep into the relationship between SharkShop and credit scores, unraveling myths, revealing truths, and offering practical tips along the way. Whether you’re looking to boost your score or simply want clarity on how Sharkshop.biz fits into your financial journey, you’ve come to the right place. Let’s get started!

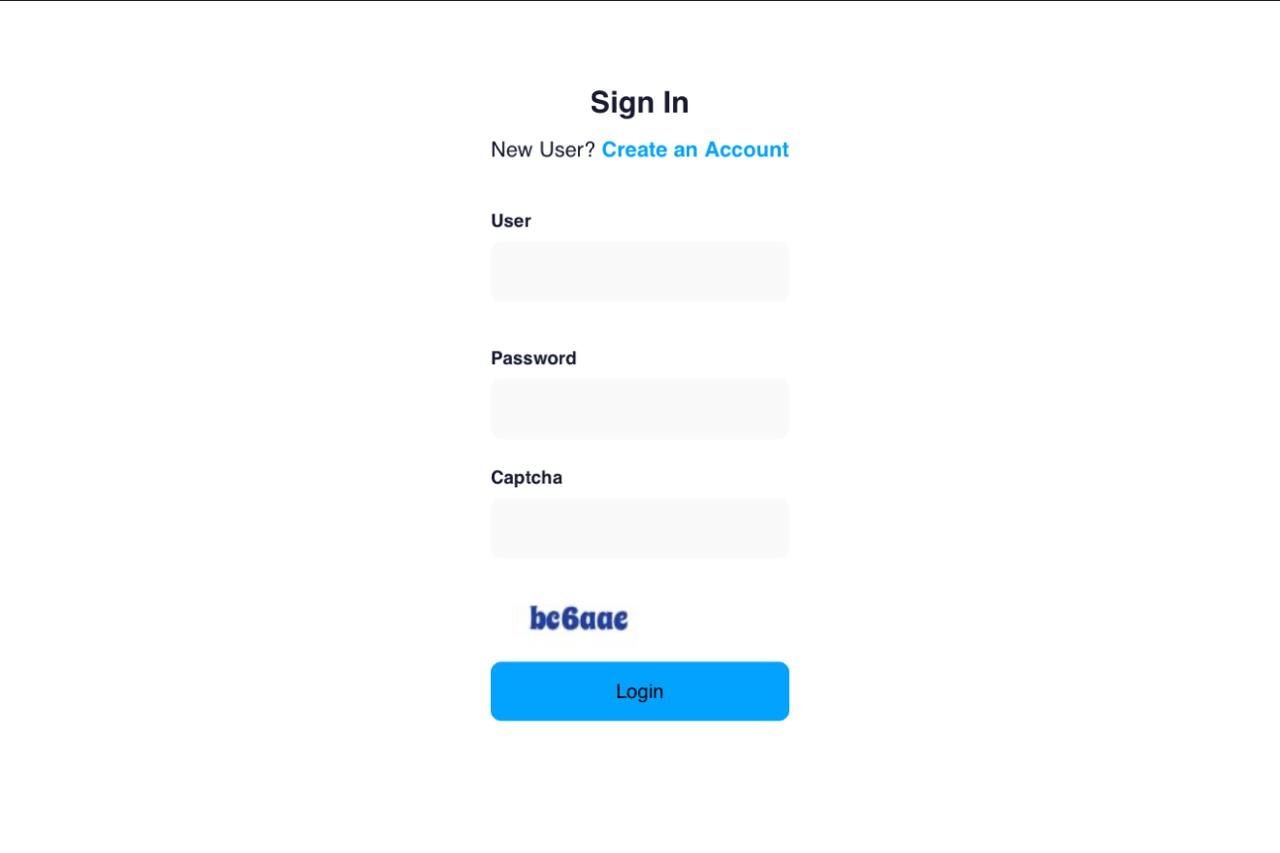

A Screenshot of Sharkshop (Sharkshop.biz) login page

Understanding Credit Scores: What Are They and Why Do They Matter?

Credit scores are numerical representations of your creditworthiness. They typically range from 300 to 850, with higher scores indicating better credit health.

These numbers are calculated based on factors like payment history, amounts owed, length of credit history, types of credit used, and new credit inquiries. Each plays a crucial role in determining how lenders view you.

Why do they matter? A good credit score can unlock doors to lower interest rates and favorable loan terms. It influences not just loans but also rental applications and insurance premiums.

A poor score can lead to higher costs or even denial of services altogether. Understanding your score is essential for making informed financial decisions that can impact your future significantly.

The Link Between SharkShop and Credit Scores

SharkShop has emerged as a notable player in the world of personal finance, particularly regarding credit scores. This platform aims to provide users with tools and resources that can directly impact their financial health.

When you make purchases through SharkShop, your activity might be reported to credit bureaus. Responsible use of this service could lead to positive changes in your credit score over time.

Moreover, SharkShop offers insights into your spending habits, encouraging better financial decisions. By tracking these patterns, users can see how their behavior aligns with healthy credit management.

However, it’s crucial to understand that simply using SharkShop doesn’t guarantee an improved score. Consistent payment history and overall debt management are equally vital factors contributing to one’s creditworthiness.

Related: Feshop

Debunking Common Myths About Credit Scores and SharkShop

Many people believe that using SharkShop automatically guarantees a high credit score. This is simply not true. While SharkShop can assist in building your credit, it does not replace the need for responsible financial habits.

Another common myth is that checking your own credit score will lower it. In reality, this practice—known as a soft inquiry—doesn’t impact your score at all. It’s essential to stay informed about your financial status.

Some think that closing old accounts will boost their scores by simplifying their finances. However, this can actually harm your score since it reduces the overall length of your credit history.

Lastly, many assume they must carry debt to build good credit. Paying off balances in full and on time demonstrates responsible management without accruing unnecessary interest or fees. Understanding these myths helps clarify how SharkShop fits into achieving better credit health.

How to Improve Your Credit Score Through SharkShop

Using SharkShop login can be a game-changer for your credit score. First, explore the various financial products they offer. Each product can contribute positively to your credit history if managed wisely.

Consider using their secured credit card option. This allows you to build credit while making manageable purchases. Just remember to pay off the balance in full every month.

SharkShop also provides personalized recommendations based on your spending habits. Take advantage of these insights to make informed decisions about your finances.

Utilizing their budgeting tools is another effective way to stay on track. Keeping an eye on your expenses helps ensure you never miss a payment, which is crucial for maintaining good credit health.

Lastly, regularly check your progress through SharkShop’s monitoring services. Staying informed will empower you to make timely adjustments and continue improving that all-important score.

Tips for Responsible Use of SharkShop to Maintain a Good Credit Score

Using SharkShop responsibly is crucial for maintaining a healthy credit score. Start by keeping track of your spending. Set a budget and stick to it, ensuring you don’t exceed what you can repay.

Always pay bills on time. Late payments can significantly impact your credit score. Automate payments if needed to avoid missed deadlines.

Limit the number of accounts you open through SharkShop. Too many inquiries in a short period can signal risk to lenders.

Keep an eye on your credit utilization ratio as well. Aim for using no more than 30% of your available credit at any given time.

Finally, regularly check your credit report for errors or inaccuracies that could affect your score negatively. Address any discrepancies promptly to maintain credibility with lenders and other financial institutions.

Alternatives to Using SharkShop for Building Credit

If SharkShop cc isn’t the right fit for you, there are plenty of alternatives to consider.

Secured credit cards can be a great option. They require a cash deposit that serves as your credit limit. Using one responsibly can help build your credit over time.

Credit-builder loans are another avenue worth exploring. These loans typically involve borrowing a small amount and making regular payments, which positively impacts your credit score.

Consider becoming an authorized user on someone else’s account too. This allows you to benefit from their good payment history without directly managing the account yourself.

Lastly, local credit unions often offer programs aimed at helping individuals establish or rebuild their credit more easily than traditional banks might allow. Each of these options offers various benefits tailored to different financial situations.

Conclusion: Is SharkShop Really the Key to a Good Credit Score?

The relationship between SharkShop and credit scores invites curiosity. Many users wonder if utilizing this platform can genuinely enhance their financial standing. SharkShop offers tools that may help individuals monitor and manage their credit more effectively, but it’s essential to understand the broader picture.

While engaging with Sharkshop.biz could provide beneficial insights into your credit behavior, it’s not a magic solution for everyone. Building a good credit score requires consistent effort, responsible borrowing habits, and awareness of how various factors impact your rating.

For those considering whether SharkShop is the key to a better credit score, it’s crucial to weigh both its advantages and potential limitations carefully. Remember that achieving a strong financial profile involves multiple practices beyond just one service or tool—education about finance remains paramount.

Ultimately, while SharkShop can be part of your strategy for improving your credit health, relying solely on any single resource might not yield the desired results in every case. Embrace diverse methods alongside using platforms like SharkShop for a well-rounded approach towards building lasting financial stability.