The global orthopaedic biomaterials market, valued at USD 21.16 billion in 2023, is projected to grow at an impressive CAGR of 7.50% from 2024 to 2032, reaching a market size of USD 40.56 billion by 2032. The increasing prevalence of orthopaedic diseases and musculoskeletal disorders is driving the demand for advanced biomaterials. In this article, we delve into the market dynamics, trends, challenges, opportunities, and key players shaping this industry.

Introduction to Orthopaedic Biomaterials

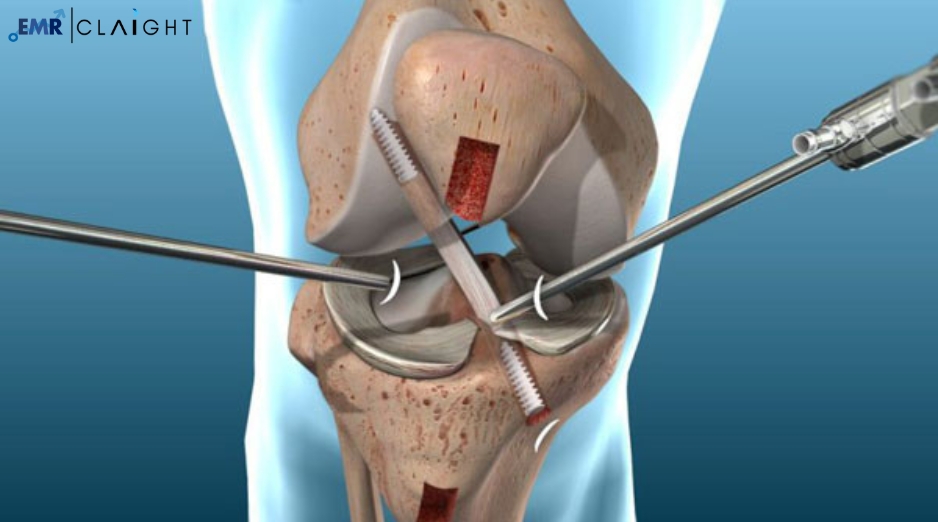

Orthopaedic biomaterials are specialised substances engineered to interact with biological systems to repair, replace, or enhance bone and musculoskeletal functions. These materials are widely used in orthopaedic implants, joint replacements, spinal surgeries, and regenerative medicine.

Their biocompatibility, durability, and customisability make them essential for addressing the rising number of orthopaedic injuries, ageing populations, and increasing sports-related trauma cases.

Get a Free Sample Report with Table of Contents : https://www.expertmarketresearch.com/reports/orthopedic-biomaterials-market/requestsample

Market Drivers

1. Rising Orthopaedic Diseases and Disorders

- Increasing cases of osteoarthritis, osteoporosis, and fractures are driving demand for biomaterials.

- According to WHO, over 130 million people worldwide will suffer from osteoarthritis by 2050.

2. Ageing Population

- The elderly population is more prone to musculoskeletal issues, propelling the adoption of biomaterial implants.

- By 2030, the number of people aged 65 and older is expected to double globally.

3. Advancements in Biomaterial Technology

- Innovative biomaterials, such as bioresorbable polymers, ceramics, and composite materials, offer better integration and healing capabilities.

- Nanotechnology and 3D printing enable the development of custom-tailored implants.

4. Sports and Lifestyle Injuries

- An increase in recreational activities and sports has resulted in more injuries requiring surgical interventions and implants.

5. Favourable Government Initiatives

- Governments worldwide are funding research and development (R&D) in orthopaedic biomaterials to improve healthcare access.

Market Challenges

1. High Costs of Biomaterial Implants

- Advanced biomaterials and associated surgical procedures are expensive, limiting their adoption in developing regions.

2. Stringent Regulatory Requirements

- The rigorous approval process for medical devices and materials can delay market entry.

3. Limited Awareness in Emerging Economies

- Lack of awareness regarding the benefits of orthopaedic biomaterials hinders market growth in certain regions.

4. Biocompatibility Issues

- In rare cases, biomaterials may cause immune reactions, leading to complications and reduced usage.

Key Market Trends

1. Emergence of Smart Biomaterials

- Smart biomaterials that respond to environmental stimuli (e.g., temperature, pH) are gaining traction.

2. Growth of Bioresorbable Implants

- Materials that dissolve after fulfilling their purpose reduce the need for secondary surgeries.

3. Integration of Additive Manufacturing

- 3D printing technologies allow the creation of patient-specific implants and scaffolds.

4. Focus on Sustainability

- Research is ongoing to develop eco-friendly and biodegradable biomaterials.

5. Collaboration Between Companies and Research Institutes

- Partnerships are fostering innovation and expediting clinical applications.

Market Segmentation

By Material Type

- Metallic Biomaterials

- Titanium, cobalt-chromium alloys, stainless steel.

- Ceramic Biomaterials

- Alumina, zirconia, calcium phosphate.

- Polymeric Biomaterials

- Polyethylene, polymethyl methacrylate (PMMA).

- Composite Biomaterials

- Hybrids of metals, ceramics, and polymers.

By Application

- Joint Replacements

- Hip, knee, and shoulder replacements.

- Spinal Implants

- Rods, screws, and cages for spinal fusion surgeries.

- Trauma Fixation Devices

- Plates, screws, and pins for fracture treatments.

- Tissue Engineering

- Scaffolds and regenerative materials.

By Region

- North America

- Leading market due to advanced healthcare systems and high adoption rates.

- Europe

- Growing due to increasing elderly populations and R&D investments.

- Asia-Pacific

- Fastest-growing region driven by rising healthcare expenditure and medical tourism.

- Latin America and Middle East & Africa

- Steady growth owing to improving healthcare infrastructure.

Regional Insights

North America

- Dominates the market with a robust healthcare system, significant investments in biomaterials, and a high prevalence of orthopaedic disorders.

Europe

- Increasing government funding and focus on innovative treatments are driving growth.

Asia-Pacific

- High population density and rising disposable incomes are spurring demand for orthopaedic surgeries and biomaterials.

Latin America, Middle East & Africa

- Witnessing gradual growth due to advancements in healthcare infrastructure and increasing awareness.

Competitive Landscape

Key players in the global orthopaedic biomaterials market focus on product innovation, collaborations, and mergers to maintain a competitive edge.

Top Key Players

- Zimmer Biomet Holdings, Inc.

- Stryker Corporation

- Medtronic plc

- Johnson & Johnson

- Smith & Nephew

- DePuy Synthes

- Integra LifeSciences

- Invibio Ltd.

- Wright Medical Group N.V.

- Orthofix Medical Inc.

Future Opportunities

1. Emerging Markets

- Expanding healthcare systems in countries like India and China present untapped potential.

2. Personalised Implants

- Customisable biomaterials tailored to individual patient needs are gaining popularity.

3. Regenerative Medicine

- Innovations in stem cell therapies and tissue engineering offer lucrative opportunities.

FAQs

1. What are orthopaedic biomaterials?

Orthopaedic biomaterials are materials used to repair, replace, or enhance the functionality of musculoskeletal structures like bones and joints.

2. Why is the orthopaedic biomaterials market growing?

The market is expanding due to the rising prevalence of orthopaedic disorders, advancements in biomaterials, and increasing demand for joint replacements.

3. What is the market size of orthopaedic biomaterials?

The market was valued at USD 21.16 billion in 2023 and is projected to reach USD 40.56 billion by 2032.

4. Which regions dominate the market?

North America leads the market, followed by Europe and Asia-Pacific.

5. What are the challenges faced by the market?

High costs, regulatory barriers, limited awareness, and biocompatibility issues are significant challenges.

6. Who are the key players in this market?

Major players include Zimmer Biomet, Stryker Corporation, Medtronic, Johnson & Johnson, and Smith & Nephew.

7. What is the CAGR of the orthopaedic biomaterials market?

The market is expected to grow at a CAGR of 7.50% from 2024 to 2032.